life insurance

life insurance

coverage you need for you and your family

Protect your journey and the people you love

The best Life Insurance agency in Toronto secures the finances of yours and your near and dear ones. It is tax-free and offers cash to your beneficiaries after you depart. There are different policies that qualify you for different insurance amounts. How much life insurance you should have depends on your individual needs.

There are two kinds of life insurance.

1. Term Insurance:

This is temporary insurance i.e 10, 20, 25, 30…… Term 100 is also available.

Monthly premium remains the same through out the coverage. Also there is a possibility to renew for another term or convert into life time policy. It is recommended when there is a heavy load of debts.

2. Permanent Insurance

- Whole life Insurance: This is the life time policy. One can do the retirement policy through dividend, paid by the policy. There is option to pay the premium, 10 years, 15 years, 20 years or life time. You can take the dividend as a loan when you have enough dividend accumulated in your policy.

- Universal Life policy: This is basically a investment policy as well as provide the coverage for your life. You have option to choose you’re the investment of your choice.

All kind of insurance plans give you a tax free benefit.

When is the best time to purchase life insurance?

The simple answer is now. Many tend to consider life insurance during major life events, such as getting married, preparing for a child, or buying a house. But, it may be wise to purchase life insurance even before these moments, and before you have people who are dependent on you.

This is because the younger you are, the less expensive your life insurance policy will be. It also removes the risk that you may not be eligible for life insurance at an older age.

Why people use life insurance

Essentially, life Insurance allows you to lead the life you want with the peace of mind knowing that your family’s future is protected. The payout from a life insurance policy can help to cover funeral expenses, and assist your family in paying outstanding debts and loans, such as a mortgage.

Life Insurance can also help to ensure that your family will maintain the same standard of living if you were to pass away.

Protect Those Who Mean The Most With A Life Insurance Policy

Get Free EstimationYour family deserves peace of mind – let us help

With the uncertainty of the future, and the twists and turns on life’s journey, it’s important that you take the time now to ensure that the people you value most will not have to struggle with financial hardship, should you pass away. When you’re ready to begin putting a plan in place, contact the licensed life insurance agents at First Choice Global Financial to help you evaluate your life insurance options.

fcglobal

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes

416.822.9709 request call back

Type Of Life Insurance We Cover

Fusce at accumsan justo. Nulla lacus efficitur vel aliquam sed, fringilla sit amet neque.

Fusce at accumsan justo. Nulla lacus efficitur vel aliquam sed, fringilla sit amet neque.

Fusce at accumsan justo. Nulla lacus efficitur vel aliquam sed, fringilla sit amet neque.

Donec malesuada urna porta tellus feugiat, ac tempor tortor ornare.

How many people are protected by life insurance?

43% of Canadian households own individual life insurance policies.

According to research, cost is a key reason that people don’t buy life insurance

When asked what they think insurance costs, many consumers cited premiums three to four times higher than the actual cost.

Reasons you should consider getting insurance sooner than later

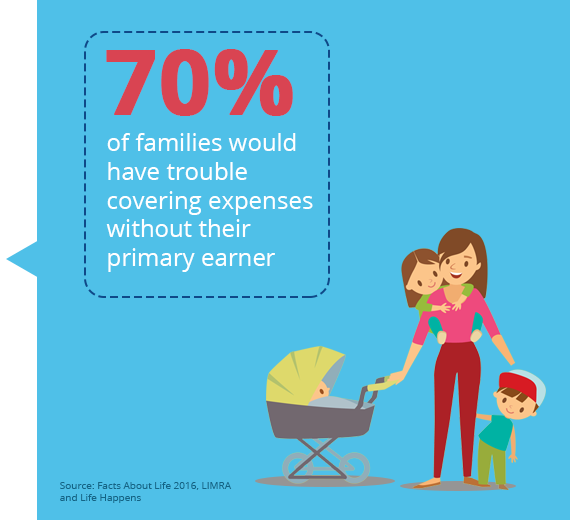

33% of Canadian households admitted that they would face immediate financial difficulties if the primary breadwinner were to pass away, and another 32% of households would only be able to last a month or two.

Frequently asked questions

what is the maximum age, a person can get the life insurance.

Age 80

can a person get the life insurance with pre existing medical conditions.

yes ( conditions apply)

Is medical test (blood, urine, ecg, etc) necessary to get the life insurance.

No, there is a privilege to get the life insurance without medical test.

can I get all my money back in life insurance policy?

There is a lot of options available which makes you to get the premium back after certain period. You can also do a retirement planning through life insurance.

Is mortgage insurance is the another name of life insurance?

No, they are two different product. Mortgage insurance cover your mortage and coverage declines as mortgage balance declines while the premium remains the same. You have to cancel the mortgage insurance if you change your financial institution. In life Insurance, there is no decline in coverage, No need to cancel the life insurance no matter who is your mortgage provider. You can choose your own beneficiary in life insurance.

Can I return the life insurance after acceptance.

yes, you can return the policy within 10 business days after your acceptance. And you will get your premium refunded.